Economy and Conspiracy

What in the world are we going to do with our economic system? It’s obviously flawed. But who knows how to fix it or how to change it? Is the capitalist system sustainable? Not as it is. We can see that clearly, can’t we? What’s the alternative? Is this the best there is?

Shortly after the last American economic fall I heard a lot of people including president Obama say that the system as it is needed an overhaul. I thought to myself that it was about time. But what have we heard since then about how we can fix it? Not a lot. It seems that suddenly it’s all going to be ok again just as it is.

I’ve seen for years that our system is not only not sustainable, but that it is actually destined to fail eventually, and probably catastrophically. It has before. We have all heard about the great depression. It was in response to that catastrophe that we changed the system to what it is now. But no economic system to date has been sustainable; no civilization has ever succeeded. Yet we think we finally got it right.

One obvious problem with our system is greed. The battle cry of the conservatives of the world: Greed is good, fell on its face with the economy. Turns out that perhaps it isn’t all that good after all. At least not when it’s excessive. But we already knew that, didn’t we?

So why do I say our economy can’t be sustained? Well first off because growth has limits and in fact it has a specific limit. Yet at every board meeting at every major company the great cry is the mandate to increase growth every year, and increase profit every year. If this is not accomplished companies fold.

They don’t fold because they cannot sustain the sales they have and cannot sustain their income, but because they can’t increase it. And why is that? It’s because most companies are listed on the stock exchange and need to make increasing profit in order to keep investors interested and happy, and more importantly get more of them.

In days gone by mom and pop businesses were all in it to make enough to survive well and get a few of the better things in life for themselves and their family. Now every business has the goal of making the owners, top executives and top investors rich. If they can’t do that they fold and put countless people out of work. Again, not because the company couldn’t survive if they weren’t greedy as well as dependant on credit given by investors; but because it can’t grow more and more every single year as demanded by this system. Investors leave, take their money out and the business goes under.

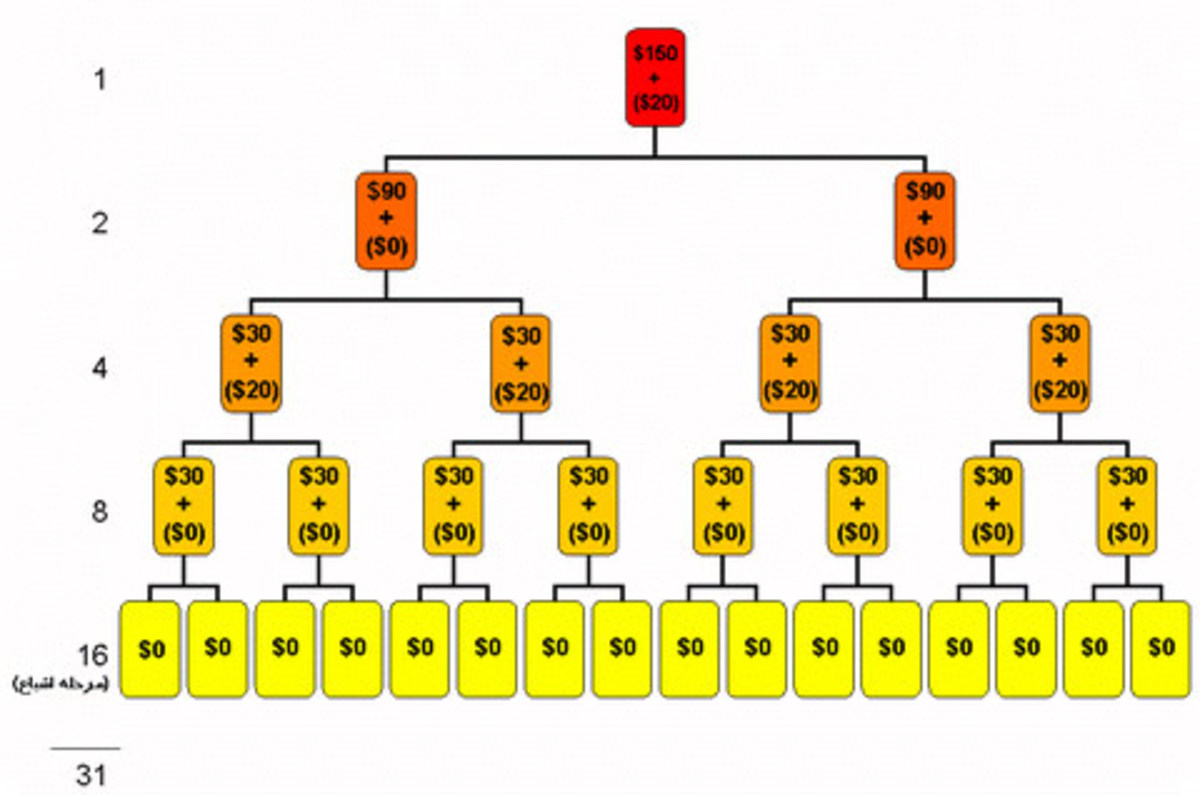

Expansion is the buzz word. Larger is better. Higher market shares. If possible buy the competition. But expansion and advertizing takes more capital, and therefore loans have to be taken out. When the business fails investors that remain till the end often lose their shirts. In a very real sense our entire economy is set up like a large legal ponzi scheme.

Capitalism is set up to make the average person believe they are better off than they are. We can negotiate a raise in pay but what happens when we get it? The price of our raise is passed on to those who use our product or service. The cost of living/inflation is raised which gets everyone asking for a cost of living raise. We get taxed according to income. We feel free and in some control of our destiny. But what has our raise gotten us? We end up paying more tax, both income and sales, and paying more for our goods and services. In many cases we are worse off when all is said and done.

A person in the late 1800s making a dollar a day could probably do as much with their money then as we can do making 100 dollars per day now. That being not much more than making ends meet if we are lucky.

We are a consumer society where everything we buy is designed to fail just in time for them to roll out the newest latest greatest version. We are encouraged to get bored of our toys even if they do last past their designed best before date. A new feature we just must have makes our model obsolete a few months after we buy it. Companies often sell us a first generation product like the first Ipad that can’t multi task when they already had the technology to make one that could. But by releasing the inferior product first they sold a lot of people two of these things in less than a year, where they could have given them the second version in the first place. Buyer beware?

Microsoft is no better when comes to operating systems that force businesses to switch to the latest model PC by creating a whole new OS instead of doing an upgrade to the old OS. A computer OS is obsolete as soon as new hardware is created with new bells and whistles.

Intel and AMD do the same thing by releasing new tech gradually as they refine their new methods of manufacture instead of giving the end result to begin with. And once a new method has gone to its limit the process begins again.

Makes sense. By sending technology out in drips and drabs they make money for research into the tech you will buy in the future. They already have what they will sell as the latest and greatest in six months from now, and are already on to what they will sell next year.

However, that growth has its limits as well. Hence why we now have tablets and phones (if you can still call them that) that almost incidentally make phone calls, as that is the least of what it can do. What’s next?

No one can keep up except the rich. We all have our limits too.

However, the one thing that drives this consumerism more than anything else is the credit card. No, it didn’t always exist. The credit card came into its own in 1966 With Master card and Visa. American Express developed the concept in 1958 but struggled with technical issues.

This ultra consumerism happened in one generation. When our grandparents wanted something they worked and saved for it. If they couldn’t save for it they didn’t get it.

Banks didn’t just lend money to anyone. You had to prove you could pay the debt. Most people didn’t go into debt out of pride. Whereas our forefathers abhorred debt, we know no limits.

I am not against change or growth or high tech. I love it all, in fact. We live in an amazing world. But it’s going to crash and burn unless our system is fixed. Consumer debt is at frightening levels. Should the interest rates rise millions of people will be in jeopardy, and they will rise.

First thing I suggest is the stock exchange be reigned in so that it does not affect the world economy to nearly the extent it does now. This is insane. But what that would look like is not something I can answer. One thing seems clear, it would have to be done as part of a complete reworking of the system. It won’t solve anything on its own. For one thing, everything is now based on debt. But more than that, our perceptions of life have to change.

Of course this is not the first time we changed our way of doing things. Economic systems have changed hundreds if not thousands of times in our history. Usually change is brought on by catastrophe. Holland’s economy once used the tulip bulb standard and got very wealthy. A single bulb was worth thousands; until others started being able to grow them and they became worthless. So if we just let it run its course, let it fail, we will suffer and be forced to find a new way, kicking and screaming. It wouldn’t be the first time, and that’s likely what will happen.

The biggest problem we have, as I said, is debt; and it’s not just we individuals. Our countries are trillions of dollars in debt. Not meeting a payment decreases your credit rating and that raises the interest rates and that means every person in the country is even more in debt. After all, how do governments pay for debt? With our money. They borrow on our behalf. Again, it’s all a giant ponzi scheme.

There are probably half a dozen conspiracy theories concerning the central banks and a hand full of men working in secret to try to rule the world and plunder it. While I wouldn’t put too much stock in any of them, their end message seems to be coming true. When a country like Greece is basically forced by the IMF to pass austerity laws, the country is being run by the bank, and the government becomes a puppet.

Who is the IMF? The international monetary fund is a group of 188 countries headed by the US. Its mandate is benevolent enough. All member countries contribute money to a fund that can be used to bail a country out if it’s in need.

But like any lender it has conditions it sets on bail out money. It wants a say in the fiscal policy of the country. In effect it puts the country in a kind of receivership. In fact part of its mandate is to watch the fiscal policies of all of its members and judge those policies.

Their comments alone can affect a country and the way it is viewed by investors in either the negative or positive.

What many people want to know is: How do we get in debt and who is the money owed to? No it isn’t The Illuminati. Our debt is mostly owned by us, sort of. They tell us the biggest owners of the national debt are pension plans, insurance companies, bonds, and mutual funds. No, the US and Canada do not owe money to the IMF, except our yearly dues.

Perhaps the Illuminati own a lot of mutual funds, I don’t know. But the US does owe billions to countries like China. It owes Canada some 98 billion alone.

Canada has always carried debt since it became a country. Probably the US has too. The way we get in debt is simple. When the government spends more than it gets from taxes in any given year it runs a deficit. That deficit is then borrowed and becomes debt. Much of it is borrowed in the form of investors buying bonds and mutual funds, etc. Anyone can buy them including people and governments in foreign countries.

But in Canada public money is also borrowed from commercial banks, isn’t it? Some, but as it turns out, not much. Another conspiracy theory down the drain.

What is really interesting is how the Bank of Canada works. In Canada it is the only institution that can print money. But over 95 percent of the money in Canada is temporary virtual money. This virtual money is created by commercial banks in the form of debt. (Loans and mortgages, etc.) There is nothing to back that money up; not GNP, not gold, nothing. It’s fiat money. That means it has no intrinsic value. The banks have very little real money to lend.

The word “fiat” is Latin for “let it be done” or “make it so.” Governments just declare its value. But commercial banks don’t have the trillions they lend us in reserve. In the end if the debt is paid back that money disappears off the books. All that remains is the interest. The principal is zero. Does that surprise you? It surprised me when I first heard about it.

The government of Canada used to set the minimum reserve of real money a commercial bank had to have, but not anymore.

In fact, all real money printed/issued by the central bank represents government deficit. The government creates money by spending more than it has. In theory it could borrow from the bank of Canada, (Print the money) charge itself low to no interest and pay the debt down with far less pressure and less impact on Canadians. Under the laws governing the Bank of Canada that would be legal.

The government already borrows from itself. Part of the debt is money that one government department owes another.

The Bank of Canada answers the question “Why doesn't the Bank of Canada just print enough money to pay off the national debt?” this way on their web page: http://www.bankofcanada.ca/about/faq\

“Because doing so would reduce the value of our money, raise interest rates, and undermine the growth of the economy — the exact opposite of our goals.

If the Bank were to print money to repay the national debt or to finance government programs, it would be adding greatly to the amount of money in circulation. This would encourage people to spend and borrow more, and the economy would receive a temporary boost. But overall demand for goods and services would grow faster than the economy's ability to produce, and this would inevitably lead to higher inflation.”

Well in theory it would. And yet credit is much easier to get than it has been any time in history and people are far more in debt than ever. The banks and credit card companies make it easy and encourage it. The demand for constant growth seems to drive it. There is something not right in all this.

All that easy credit and those credit cards are only possible because the commercial banks are allowed to create debt. That’s why banks in our forefather’s day couldn’t do it. They had to have real money to back them up. Now they don’t.

That has lead to another conspiracy theory that says that the banks and the government have conspired to make us all debt slaves. Again, I wouldn’t say it’s a conspiracy. It’s just a fact that the system, our greed, our desire for new exciting things, the advertisements bombarding us from all directions telling us we need to buy more, make it a fact of most our lives. We are debt slaves. If we don’t like it we need to ask questions and change it.

A ponzi scheme is an investment scheme whereby the investor is paid interest from their own money or the money of other investors instead of through the successful sales of goods or services.

It depends on getting more and more investors all the time, and/or making the interest so high that the original investors keep pumping in more money in the hopes of getting rich. Eventually, of course, the fraudster gets in too deep and goes to South America for an extended holiday, or to jail. In either case investors lose everything.

The only difference between a ponzi scheme and the economy is that the government can print money to back up its scheme and keep it going. But not forever. Stuff always happens. And what happens most often is inflation.

In the 1950s the Canadian government was running the country by simply printing money when it needed it. Wish I could go print more as I need it, but that’s not allowed for the same reason it isn’t a good idea for governments to do it. Inflation runs rampant.

This is basic supply and demand economics. Say the government gives us all a million dollars one morning. We are suddenly all rich. The theory is that if we can all afford anything we want we will have no incentive to work or produce anything. Goods would become more expensive and scarce. Our money would not be worth as much. An example is found in the Middle East where Oil rich countries often have to import their goods and servants from other countries.

Say we all have the money and desire to buy a Bentley. The theory is that Bentley suddenly cannot keep up with demand. They have to hire more people and buy more material which drives up their costs.

But they are selling more product so it should come out even. They should have a bigger market share which is what they want, right? Ok, maybe I’m missing something. If everyone in the world was rich there wouldn’t be anyone to make Bentleys. See what I mean about there needing to be poorer people to make it all work? Some one wins and someone far less well off produces what the winners want.

Look at what happens at concerts that sell out. Scalpers who have bought extra tickets can practically name their price. Greed and low availability is what drives up prices. Charge what the market will bear. Not what it costs to produce plus a fair mark up; as much as you can get in the market you are in. That’s the wisdom.

There are no standards, and that’s the problem. There is no equilibrium. But that is why it is called a free market system. It’s a chaotic system which runs on simple rules where in small perturbations add up to dramatic shifts and overall unpredictability. Everything economists tell us is theory. Economy is like weather, it cannot even in principal be predicted accurately in the long term.

Not everyone can be rich, and in fact, not everyone can even have a job. Economists and governments tell us for a healthy economy there has to be a level of unemployment. The level of unemployment that is optimum is disputed. It ranges from 3 to 13 percent depending on who you listen to.

Enter the central bank. They have a tool that in theory keeps inflation down and keeps us at the “right” unemployment level. They control interest rates. Interest rates go up and people lose jobs, businesses fold, and inflation is stabilized; theoretically creating price equilibrium. The optimum rate of inflation is two to three percent according to the Bank of Canada. In times of depression or recession interest rates fall and more money is available. People borrow and companies hire.

While in theory anyone can get rich, in reality not everyone can get rich, and the system is geared to making sure that not everyone will get rich. In fact it is geared to make sure some fail so others will prosper. It’s nothing personal. It’s what’s best for all. Contrary to what many people believe it is a win/lose situation. Does it have to be? No.

The system relies on all of us being deep in dept. It relies on a certain amount of us being unemployed. It relies on greed to work.

Is this a conspiracy? No. Every economist knows about it and you can look the information up online from places like the IMF and The Bank of Canada’s web pages. It is clear, however, that they do have an agenda. It’s not surprisingly a conservative capitalist agenda.

Is the IMF trying to take over the world? In a sense that’s exactly what they are doing by their own admission and through their own mandate. Perhaps not so much take it over as unify it.

Their mission is to monitor the economy of all nations and work with central banks and governments to facilitate the globalization of free trade and create a world economics. The idea is to make a world market a level playing field so that the standard of living in all countries can rise, every country can have a stable economy, every country can have sustainable (constant) growth, and poverty can be ended.

Well we all like the idea of ending poverty, but the economics we are using demand a certain level of it for the system to work. Perhaps they use the phrase ending poverty like they use the word full employment. It doesn’t mean the same thing to an economist that it does on the street.

When an economist says full employment they mean, as I mentioned before, an above zero unemployment rate between 3 and 13 percent. The theory is called NAIRU. It depends on the structure of the economy how many unemployed are needed for that particular economy to function well.

So since most countries in the west use this method and since it is a method the IMF advocates, they can only mean reduction of poverty to within optimum limits above zero.

I am not a conservative myself but unlike some I don’t think they mean harm, and in fact they honestly think they are doing good. But are they?

Margaret Thatcher is both accused of destroying countless lives due to her austerity measures, and considered a hero of the conservative capitalist cause. The rich must get richer so they have more incentive to create more jobs. It’s the trickledown theory of Regan fame. Only it doesn’t always trickle down fast enough or at all.

I also have nothing against the wealthy and wouldn’t dream of demanding they share it. Many actually worked very hard to gather their wealth and good for them. But one has to wonder about the economists take on human nature. Were I wealthy my first thought would not be of making more, it would be how to make my wealth work to make me free from struggling day to day for the rest of my life, and not having to worry about money/ I actually don’t like money much, but what can I do?

A million or two would about cover it. The only job creation I would be contributing to would be resorts in warm places. Really though, all I need is enough to live comfortably. Extreme wealth has never really interested me. I’m certainly not alone, and the economy depends on people like us.

Is greed really good and is it really our most basic instinct as conservatives attest? Certainly there are no selfless acts, but selfishness is most often really best served in win/win interactions. Our system doesn’t really understand that, and it certainly isn’t geared toward it.

Now really there has always been a class structure even if class is not forced on an individual by the culture.

There have always been the poor, the not as poor, the working poor, varying levels of middle class, and varying degrees of wealthy. Some are where they are because of personal issues, some because of life choices they made in the past, some are there because they like their lives, and some in all classes hate their position in life.

So the economy is geared toward those with a bent for constantly more. The economy thrives on big business that has bought up most of those mom and pop concerns, leaving the small business people who used to be the engine of the economy no more than 60 years ago, unable to compete. Only big business can compete on an international scale, so the system favors it.

Now, I love the idea of a united world without borders. Sounds great. The thing that keeps it from happening is that every culture likes to have sovereignty within its nation. But in reality our global economics has already removed our sovereignty. Trade agreements have stipulations and rules that govern and bind law makers and policy makers to tow the line. This often and with more frequency means that our laws are dictated by the international community through our elected members. We are no longer running our own countries.

Is that good or bad? Probably it’s both depending on your perspective. Hence why there are so many G20 demonstrations. However, in many ways it’s exactly what the EU has signed on to, and it’s how relationships between states or provinces work; just on a much larger scale.

For those that don’t know: the G20 is a group of 20 finance ministers and their central bank governors, along with the head of the EU. Together they represent the 20 major players in the world who together have 80 percent of the world’s GNP. This organization was proposed by former Canadian Prime Minister Paul Martin. Their mission is co-operation and consultation concerning the global financial system.

The deed is done. One country goes down and we all suffer, just as we would all suffer if a state or province were to fail. Globalization is already a fact, even though there isn’t a level playing field yet. The IMF and G20 didn’t start it, they are a result of it. They are the ones trying to organize it. In effect, they are the illuminati trying to unify the world.

Globalization has been building naturally for a long time now. It started with ease of travel. The airplane made the world smaller. Fast communication over vast distances was another factor. The internet made us a global community. But the thing that has had the biggest influence is trade.

Trade has always brought people and nations together since our beginning. Fast planes and ships help trade. Fast communication helps trade. Big business interests are best served with large markets, and large markets are best served by large corporations. So far the largest market is the world.

It’s funny but tyrant after tyrant have tried and failed to unit Europe since Charlemagne. But trade is what finally did it peacefully. Will the same happen to the rest of the world? That’s what our financial systems are working toward. I have to admit that I like the idea, but I’m dubious about how it is being done.

As a child I thought that the world was already united. I later envisioned a day when it would be. But it was a Star trek kind of vision, even though Star Trek hadn’t been created yet. Of course knowing what I know today about the world I can see why it didn’t happen before. People are too nationalistic and too afraid of others. Perhaps this is the only way it will come together short of finding a common threat from space, as so many Science Fiction novels and movies talk about.

Yet, can it happen? Or will it fall apart before it starts?

One problem may be oil. The estimated time for peek world oil is 2020. After that oil prices will sky rocket as supply quickly dwindles while demand will no doubt be higher than ever, despite warnings of global warming if we continue using it indefinitely. 2020 is in 8 years as of the writing of this text. Not that long from now. Will we have viable alternatives by then? Will we be ready? Not likely.

Now, of course, oil will last beyond 2020. But for how long is up for debate. We have more than enough oil to last us hundreds of years, but our technology isn’t good enough to get to it all.

So oil will run out sooner than we think. If no real alternative is found, what will our trucks and planes run on? How will we trade?

This one problem threatens to drag us back to an age where everything must be done locally. There are already people who are trying to live locally, buying only local produce that is in season. But what about products? Back to mom and pop stores and the old ways of doing things?

It would once again be a very different world until someone comes up with the next miracle fuel to run industry on. And yet there is no real need for panic just yet. Natural gas is not going away any time soon and won’t run out in the near future. We can even get it out of rock these days. Prices for it are falling. Yet no one is as yet putting natural gas stations at every corner, even though 30 years ago when I was in the gas industry that’s what they said was just around the corner. We even had the ability back then to set up filling stations in every garage from the houses supply. Where is that technology now?

I’m no economist, I’m a philosopher, so I am not going to try to give a solution to these problems. I just want to point out that those who are economists might want to start thinking and looking outside the box for a win/win system. Human nature may be greedy, but that doesn’t mean it needs to be indulged. It needs to be directed, and not toward destruction. There has to be a better way of running things than a large ponzi scheme, don’t you think?

We do evolve as a species, so it is my hope that those who are interested in this subject will educate themselves in an attempt to find it. As for me, the mention of finance makes my eyes glaze over. This text has come to be because I wanted to know the truth behind some of the conspiracy theories I’ve heard.

I’m satisfied that there is no conspiracy. It’s certainly not the Jews, it’s not the Illuminati; it isn’t even the Bilderberg Group. It’s conservative capitalism which is trying to take over and unite us in a new world order. But we already knew that, didn’t we?

What if anything are we going to do about it?